The Association of Independent Festivals has called for an investigation by UK authorities into the dominant position that Live Nation holds over the sector, according to a release issued earlier this week. The organization found that the U.S. based promotional giant now controls over a quarter of the entire festival market in the UK, three times the share of its closest rival.

“AIF’s festival ownership map paints a stark picture of the sector,” AIF Chief Executive Paul Reed said in the release. “Allowing a single company to dominate festivals, and the live music sector in general, through vertical integration, reduces the amount of choice and value for money for music fans. It can block new entrants to market, result in strangleholds on talent through exclusivity deals and stifle competition through the entire live music business.”

“AIF has been sounding the alarm for some time now but the effect on the independent festival sector continues,” he continued. “Simply put, this damaging market dominance needs to be given the scrutiny it deserves.”

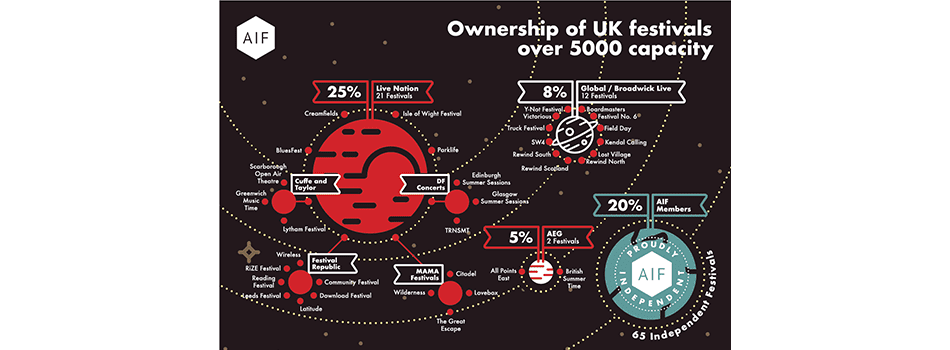

According to AIF, Live Nation controls 25.6% of UK festivals over 5,000 capacity. The nearest competitor is Global at 8%, followed by AEG Presents at 5%. AIF members – 37 independent companies controlling 65 festivals – come in at just 20% of the market total. The organization is hoping it can leverage these findings to spur the UK Competition & Markets Authority to investigate the company’s market dominance and whether or not it is healthy for consumers.

One festival organizer told The Guardian they had been unable to book many acts, even small ones, due to exclusive contracts they entered to perform at Live Nation events. “Nobody wins from that,” said the promoter, who remained anonymous presumably due to fear of retaliatory action against their business. “We’ve all got an interest in the bands and the scene flourishing. Muse, U2, Madonna, they all learned their trade by playing festivals where they can. This is the height of anticompetitive behavior, restricting bands from playing live shows.”

Another factor cited in the request for the investigation is the company’s ticketing operation, Ticketmaster. Through the ticketing giant, Live Nation controls just short of half of the venue box offices in the UK. It also currently holds a large share of the secondary ticketing market in the country through subsidiary companies Seatwave and GetMeIn. That will change later this year, as the company shifts to a value-capped resale marketplace serviced by Ticketmaster directly – which may further consolidate the company’s hold as regulators continue to squeeze competing resale marketplaces like Viagogo and StubHub.

Visit https://aiforg.com/aif-publishes-uk-festival-ownership-map-and-stamp-of-independence-renews-call-for-competition-investigation/ to read the full release.