by Mike Giuffre, Special to TicketNews

Limiting purchase capabilities through restrictions has never been an acceptable model in any retail based industry. That’s the core reasoning of why you’re now seeing a rash of stories about what was once considered a “can’t miss” fight of the century falling flat on its face once it went on sale.

Last Monday, the highly anticipated boxing match between unbeaten Floyd Mayweather and MMA star Connor McGregor went on sale. It did so with a steep pricing philosophy built on no data, and tight restrictions. What occurred was a shocking lack of sales, leading to back end panic.

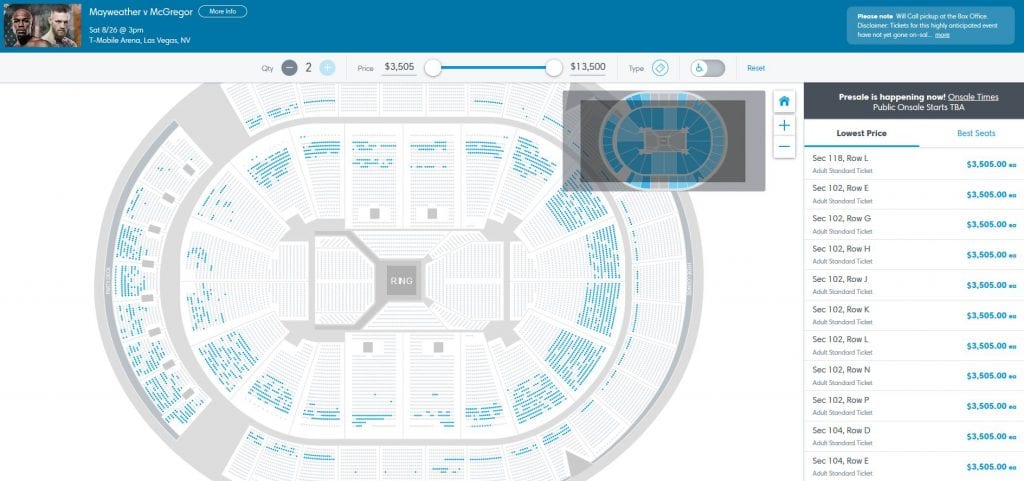

Casual users may not have noticed, but hiding the interactive map showing available seats and listing primary tickets as secondary at a lower cost were giant red flags for those who are regulars on events of this magnitude.

Let’s examine what went and continues to go wrong with the event and how promoters can avoid failures like this again.

Where McGregor-Mayweather Planning Went Wrong

The definition of insanity is doing the same thing over and over but expecting different results. We are two decades into the online retail era, and as other industries move forward digitally ticketing is still lagging with outdated ideology based on the Fear Of Missing Out (on revenue). The same mistake of worrying about revenue loss on a small percentage of your inventory instead of guaranteeing upfront sales, leading to increased sales, short and long term revenue gains and data continues to be a major roadblock.

The truth is there are clear reasons why other industries continuously invest in partnerships to move inventory. The most obvious is they are more profitable because of it. The amount of energy and effort that takes place because of FOMO would alone be an argument. However, data utilization, marketing dollars, and distribution combine to make online retail a powerful tool. Additionally, one off events have needs for distribution because they lack the longevity of data, carry an even smaller marketing infrastructure or budget as well as any relevant history to make pricing decisions.

With that in mind, here are four core reasons why sales have hit rock bottom, all exaggerated because of its one-off event status:

The Missing Infrastructure of Distribution

The rules in place to limit secondary accomplishes three things:

- Selling fewer tickets for less revenue to avoid losing additional revenue on 15% of the inventory

- Making less money overall because you worried about 15% of your inventory

- Losing digital reach through retail infrastructure

As I wrote about here, the secondary market accomplishes what retail figured out two decades ago when it comes to online sales. The combined marketing dollars through distribution channels allows websites to utilize budgets sizable enough to handle digital outreach for them. In short, one can scale, the other cant.

I have spent time researching and following the sales for this event online. Despite this footprint and because the restrictions-limited distribution, I have seen zero retargeted ads to me. Not on Facebook, any ad hosting websites, or on any google-supported platforms. The reason is that venues alone cannot afford this outlet – but secondary sites can. Team and venue sites are not responsive nor designed to work within search optimization features such as indexed pages or affiliate links back. With no inventory being distributed and pricing not based on demand, there is limited investment from these channels. The pricing and inventory management is costing the event millions of dollars in free online advertising.

Finally, secondary market sites carry the data and historical analytics to maximize sales based on high volume periods. Prices peak during the initial on sale, once an event is announced as a sellout or even when news breaks. The mismanagement of these tickets caused a lack of overall sales and more missed revenue by not maximizing on what hundreds of thousands of past events show as possible.

While the core reasoning for lack of sales correlates with poorly designed pricing and restrictions, the lack of any support from digital or email marketing based on online consumer profiling has not added any additional sales or revenue.

Sticker Shock does not Equate to Lost Revenue on all Tickets

One of the more curious sides in the ongoing battle of distribution is the human element of sticker shock. Seeing inflated prices creates a feeling of the before mentioned FOMO (I wrote here why pricing based off of secondary is a losing proposition).

Analytically this makes little sense because not all tickets will sell for the listed price (although the media promotes unrealistic scenarios in listed prices), some tickets will sell for less than gate price, and inflated prices are only on a smaller percentage of the seats.

This event is a perfect of example of the failure. If you priced and marketed better, you would have sold out and some would have sold for a profit on the secondary. However, I fail to see how that is a worse solution than limitedsales leading to spending time and money on poorly hidden solutions to move inventory without admitting your mistake.

The secondary data from Mayweather’s past fight vs. Manny Pacquiao shows an average price of just under $4,000 per ticket. His past fights dating back to 2013 all averaged well less than $1,000. The sticker shock of the Pacquiao Fight caused the decision makers to forget that these prices were based off a limited number of seats sold and it already being sold out. They also did not analytically decide that a Mayweather vs. McGregor ticket would be more in demand than when he fought Pacquiao.

This fight has garnered attention as it has become more of a circus than reality. There was nothing in TicketCity data and marketing research that showed pricing should be as high as it is. So, the median price on the secondary is technically higher for the McGregor fight as of today; it is for a lot fewer tickets sold. And will drop as there continues to be primary inventory masked as secondary with a decreased price.

Risk Management (or lack thereof)

By putting restrictions on ticket buying and charging inflated pricing, the promoters took all the financial risk. The two tradeoffs of retail infrastructure are upfront cash and all that comes with distribution. The season ticket model works in a similar fashion. Team performance, injuries, weather and other circumstances can raise or lower the price through these channels. Because the risk is spread out to multiple accounts, the model never fails as no one person or entity will take too big of a loss in a downturn.

The common myth is that all seats on the secondary sell for a hefty profit. With thousands of events and games each day, there are plenty of tickets that sell below face value. Hence, the risk management for rights holders and the reason the model works for the consumers in the first place.

By creating too many restrictions to ensure they collected the FOMO based 15% in additional revenue, the promoters have cost themselves millions. Was it worth the risk? No.

When Distributed Correctly, the Increased Ticket Prices are Based on the Event Selling Out

This is common when it comes to supply vs. demand but is worth mentioning. The increased revenue that creates FOMO is only possible once there is no supply. By creating plenty of supply and managing to also implement a confusing and ongoing hidden pricing structure to hide the failure, the demand becomes choppy. Until the demand outgrows the supply on the primary, it is not possible for price increases on the secondary.

This event is combination of possible revenue streams not outweighing the risk along with a poorly constructed pricing and marketing model based on FOMO. As we stand on Sunday Night, July 30th, there are thousands of tickets left with those remaining being stubbornly miscast as lower priced secondary seats. The cost of FOMO has been millions of dollars. Will the insanity continue or will we as an industry work to create a new definition of ticket distribution? One based on forward thinking and modern business modeling? History says we have a long way to go before we even entertain the thought.

Mike Guiffre is the Vice president of Sales for TicketCity. This article is an updated version of one he originally published on LinkedIn. Mike can be reached at mike@ticketcity.com, on Linkedin, or on Twitter @mjguff.