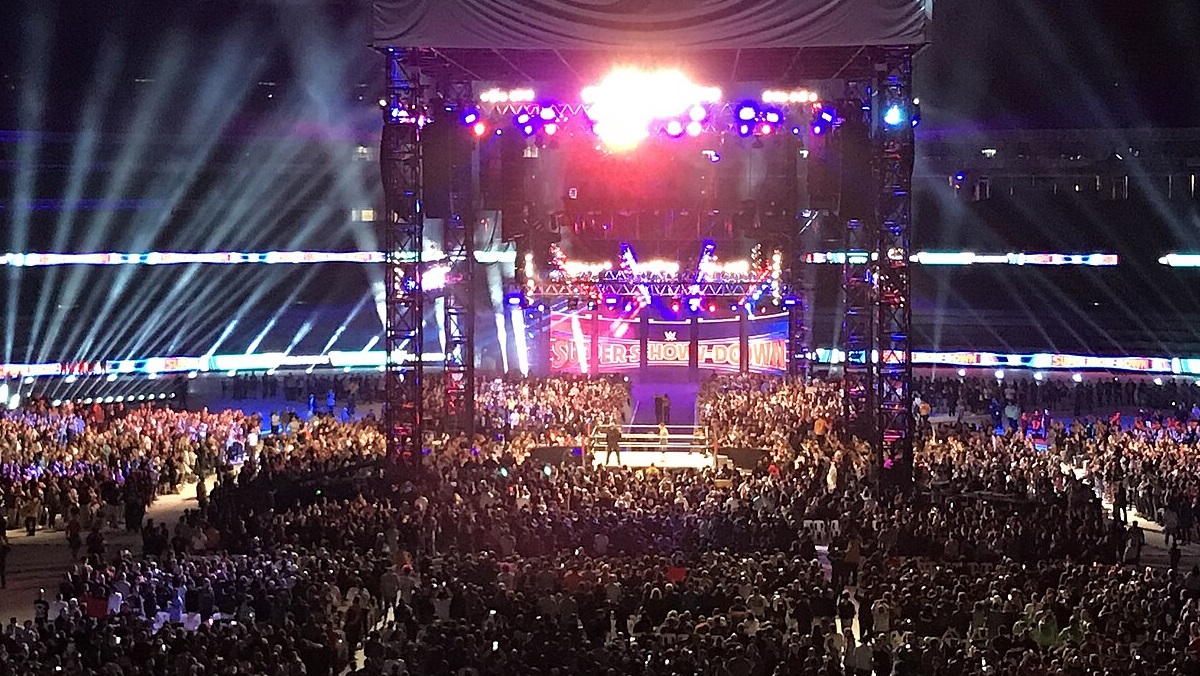

WWE is under fire from fans and former talent over surging ticket prices that many say have made the once family-friendly spectacle unaffordable for the average household.

According to data compiled by Wrestlenomics and reported by multiple outlets, average ticket prices for WWE’s North American TV events have nearly doubled since the company merged with UFC under TKO Group Holdings in 2023. Prices for RAW and SmackDown have jumped from about $75 last year to $118 in 2025, while premium packages for WrestleMania 41 in Las Vegas reportedly reach as high as $38,000 for a two-night experience.

The sharp increase has prompted criticism from long-time fans and even former stars, who argue that WWE’s shift toward premium pricing signals a departure from its working-class roots.

On TMZ’s Inside the Ring, former wrestler Maven Huffman accused the company of “abandoning the everyday family” that once formed the foundation of its fanbase.

“You can say what you want about Vince McMahon — Vince knew that the everyday family was where his bread was buttered,” Maven said. “He knew that in order to create generational fans, he was going to have to make his product accessible… I remember going to my first show when I was seven. My dad spent about $300 for the whole family — tickets, parking, food, everything. Now you’re not even getting one good ticket for that.”

The former Tough Enough winner said the company’s strategy under private-equity ownership risks alienating generations of loyal fans in favor of higher-yield corporate buyers and luxury experiences.

Wrestlenomics’ analysis supports that concern. The outlet found WWE ticket prices rose roughly 60 percent year-over-year, far outpacing increases seen in other major sports leagues like the NBA (up 21 percent). Despite those price hikes, attendance has remained steady, averaging about 11,500 to 12,000 tickets sold per event in 2025 — a sign that scarcity and strong demand continue to fuel record revenues even as affordability declines.

Former RAW General Manager Eric Bischoff, however, defended the company’s strategy during his 83 Weeks podcast.

“You have a product, people want it, and you keep increasing that price until you find your threshold,” Bischoff said. “I’m not shocked… It’s interesting to me that people are surprised any company would continue to increase the price of the product until they find that threshold.”

WWE executives have echoed that logic in investor calls, with TKO President Mark Shapiro previously stating that the company still has “work to do” in maximizing ticket revenue.

For fans, though, the numbers tell a different story. Many lifelong supporters say the cost of attending even a mid-tier live show has reached levels once reserved for major league sports or high-end concerts — undercutting the sense of accessibility that helped WWE grow into a global entertainment brand.

“Football’s doing it. Baseball’s doing it,” Maven said. “They’re all chasing corporate money, but the families — the people who filled the seats in the first place — are being priced out.”

Whether the backlash prompts WWE to rethink its pricing strategy remains to be seen. For now, its balance sheets — and sold-out arenas — suggest the market is still willing to pay the premium, even as some fans decide to stay home.

Across live entertainment, WWE’s price surge mirrors a wider shift toward premiumization: concert tours have leaned into VIP add-ons and dynamic pricing, major sports have expanded club/suite inventory and variable pricing, and venues face rising operating costs—from security to insurance to labor—that get passed through to consumers. Layer in platform fees and reduced supply (fewer dates or tighter holds), and the market naturally skews toward higher per-cap revenue even as some fans opt out. For now, strong demand keeps arenas full, but the long-term health of the ecosystem will hinge on whether promoters, teams, and ticketing platforms maintain enough accessible inventory to keep new generations coming through the doors.