By: Eric Fuller

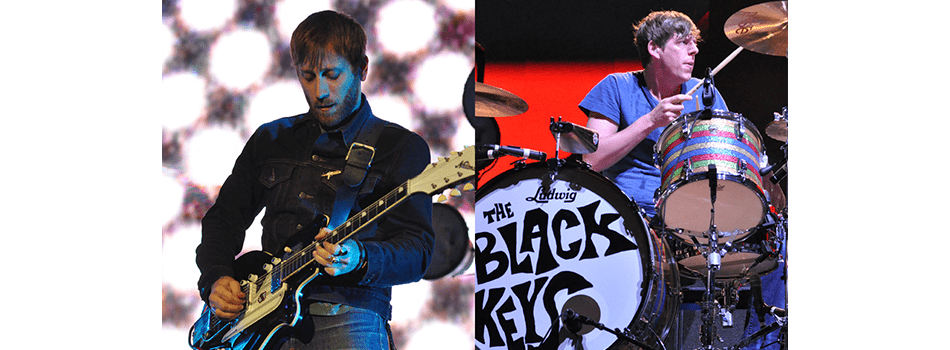

Dan Auerback and Patrick Carney are The Black Keys, an American garage, blues and indie rock band which has not toured for the past six years. Dan handles guitar and vocal while Patrick plays the drums. Although their band is essentially two people, they are known for making a lot of noise. They sure did last week.

In celebration of their new tour, The Black Keys announced an intimate show at The Wiltern Theater in downtown Los Angeles for September 19, 2019. Most tickets were $25, with a smaller selection of premium seats at $75. The Wiltern holds between 1,850 and 2,300 people depending on the configuration of seats. The next day The Black Keys would headline the Life is Beautiful festival in Las Vegas before setting off on a tour of arenas seating between 15,000 and 22,000 people. Their next stop in Los Angeles is November 19, 2019 at the Forum which seats about 17,500. So, predictably, demand for the Wiltern show was somewhere between high and insane. The show sold out immediately and tickets showed up on secondary market sites like StubHub for hundreds of dollars.

Here’s where it gets weird: Apparently, The Black Keys directed Ticketmaster, the company which sold the tickets, to turn off the ability to transfer the tickets from the original buyer to a subsequent buyer. As a result, everyone who showed up at the Wiltern with tickets bought from any of the major resale markets was dropped into a nightmare. Hundreds of people got themselves to downtown Los Angeles, paid for parking, stood in line to enter the Wiltern, cleared the security sweep, presented their digital ticket to enter the theater and were unceremoniously escorted back outside. Los Angeles television stations ran helicopter video showing hundreds of people who followed the normal rules of buying tickets through the multi-billion dollar secondary markets standing on the street outside the Wiltern frantically trying to get a resolution. Reportedly, after media reports gathered steam, the Wiltern relented and admitted some of those who still remained outside the theater.

Here is the L.A. Time’s article:

https://www.latimes.com/california/story/2019-09-20/black-keys-wiltern-tickets-ticketmaster

Here is the story reported by Trade publication TicketNews:

https://www.ticketnews.com/2019/09/safetix-hundreds-locked-black-keys-wiltern/

And, here is the story run by Variety:

https://variety.com/2019/music/news/black-keys-hundreds-turned-away-wiltern-ticketmaster-1203344146/

So, what does this have to do with eBay (NASDAQ: EBAY)? eBay owns StubHub, the largest ticket resale marketplace in the world, with sales exceeding $5 billion annually. Under pressure from activist shareholders, eBay has put StubHub up for sale. Reportedly, they are expecting it will sell for $3 billion or more. Last month I published an article suggesting the true value of StubHub might be closer to zero: https://www.ticketnews.com/2019/08/stubhub-marketplace-for-sale/

The main point of the piece was that StubHub and the other secondary markets revenues are entirely dependent upon tickets being transferable. However, with the advances in digital ticketing technology, that’s not a certainty. And, on September 19thin Los Angeles, CA we saw it play out as ugly as possible. The Black Keys sold tickets with the restriction that tickets would be delayed until 24 hours before the show. There was no notice that transfer of the tickets would be blocked. Many tickets went directly to The Black Keys fan club members. Some tickets were bought for resale by ticket brokers. Those tickets went to the secondary market where they were bought by fans of The Black Keys, but for a much higher price. The profit from those sales was split approximately 35% to the market, 65% to the seller. This is normal commerce in a capitalist economy. Prices rise and fall according to the laws of supply and demand.

Because The Black Keys did not want ticket speculators to profit by gaming what they saw as a gift to their fans, they directed Ticketmaster to invalidate all tickets which were transferred or resold. Those fans with tickets they were only able to get by turning to the secondary market had a horrific experience. But, as bad as it was for those hundreds of people, it’s about to get worse for the millions of people who own eBay stock, either directly or as part of an index fund.

This was not a one-time event. On September 21stat the O2 in Manchester, the same scenario played out for the Radio X show starring Liam Gallagher tickets. Tickets acquired on the secondary markets were refused. Some reporting said the only way in for those people who bought tickets on through ticket resellers was to bribe the staff manning the doors.

The following was posted to Twitter:

Andy Taylor (@andymtaylor81)

Absolutely piss poor @O2RitzManc tonight for @liamgallagher at @RadioX gig. Refusal to recognise resale tickets. Security a disgrace man handling people and going nose to nose with upset attendees while touts openly liars with bouncers @StubHub @viagogo @Twickets

Pandora’s box is now open. We just had live, real life demonstrations of the ability to change a ticket which was sold without restriction into one which became non-transferable retroactively. This proves my point about the value of StubHub. KKR, Silverlake Partners, Vivid Seats and all the other potential acquirers of StubHub now have to face the actual reality there is no predictable assurance tickets will be transferable in the near future. Therefore, since the entire revenue model of resale ticket markets depends upon the ability to sell and transfer tickets at scale, the value of those companies is tanking faster than the IPO hopes of WeWork. Who in their right mind would take on the liability of knowingly selling tickets to the credible public when there is a roulette wheel spinning on whether the tickets will be accepted at the gate. And, now forewarned, what lender would extend credit to companies who are squarely in the sights of both regulators and class action attorneys should they continue to sell tickets which turn out to be valueless.

I believe that Capitalism allows for anyone to buy something which is undervalued and sell it for true value. That applies to stocks like Apple which are periodically beaten down mercilessly by the market, paintings which are sold in garage sales but turn out to be valuable, songs recorded in a home bedroom and become worldwide sensations, houses which are more valuable after some refurbishment and, yes, event tickets. Any item which is in demand will have a scarcity premium which may or may not be sustainable. Baseball card values fluctuate, so did prices for Beanie Babies, Pokemon cards, and this generation’s current obsession — fashion sneakers. The seller gets to price an object, the market applies the “Goldilocks” test and decides if it’s priced too high, too low or just right. Price something too high and it lingers unsold, price it too low and it gets bought out rapidly and likely resold. Price it just right and supply balances demand. The only other pricing model is imposing a price and backing it with consequences if the use is not what the pricing authority intended. That was the model in the former USSR. We called it Communism, although it was really Socialism. And, we learned all the way back when Ronald Reagan was President that model was not sustainable. The Berlin Wall fell and entrepreneurs gained control of industry which used to be state controlled.

I also believe in the law of unintended consequences. The Black Keys really did intend to do something nice for their fan club. But, in trying to punish the few people who took advantage of the under-market price for their Wiltern show tickets, they ruined what would have been a spectacular event for their fans who had no option other than to get tickets from the secondary market. Any high demand event with limited capacity cannot accommodate all the demand. The secondary market sorts that out by balancing supply and demand using price. The higher the price, the lower the demand. Eventually we reach equilibrium. I don’t think the Black Keys intended to punish eBay shareholders or really offend their fans who paid a lot of money to get the only tickets they could, those which turned up on the resale markets. But, there’s that unintended consequence.

My take on this is simple: we need balance. Some tickets get sold to fans directly at the on sale. Some go into the secondary market allowing those who didn’t get tickets in the first sale another chance. Or, allowing those who don’t know today that they want to see Green Day when they play San Diego in July 2020 a chance to get tickets on the day of the show. This is a $20 billion market. It’s too big for any person or company to control. It’s practically its own economy. Let it be. Markets always sort themselves out. That’s how it works in America.

This post was originally published at https://medium.com/@ericsfuller/how-a-25-black-keys-concert-ticket-may-wind-up-costing-ebay-shareholders-3-billion-ccedaae34519

Main Photo: The Black Keys perform at Coachella in 2012. Photos by Jason Persse, via Wikimedia Commons https://commons.wikimedia.org/wiki/File:The-Black-Keys-Coachella-4-20-12.jpg