Did you resell more than $600 worth of tickets this year to The Eras Tour? How about Beyonce’s Renaissance show? If so, be prepared to pay taxes.

A new law, issued by the Internal Revenue Services, comes on the heels of the American Rescue Plan Act, which has sellers pay taxes on the profits they made over the year. According to the Wall Street Journal, the law will require ticketing companies to report if customers sold more than $600 in resale tickets in 2023. Previously, ticketing sites had to send a 1099-K form to sellers who made more than $20,000 through 200 or more transactions.

“Payment apps and online marketplaces are required to file a Form 1099-K if the gross payments to you for goods and services are over $600,” the IRS said in a statement. “The $600 reporting threshold started with tax year 2023. There are no changes to what counts as income or how tax is calculated.”

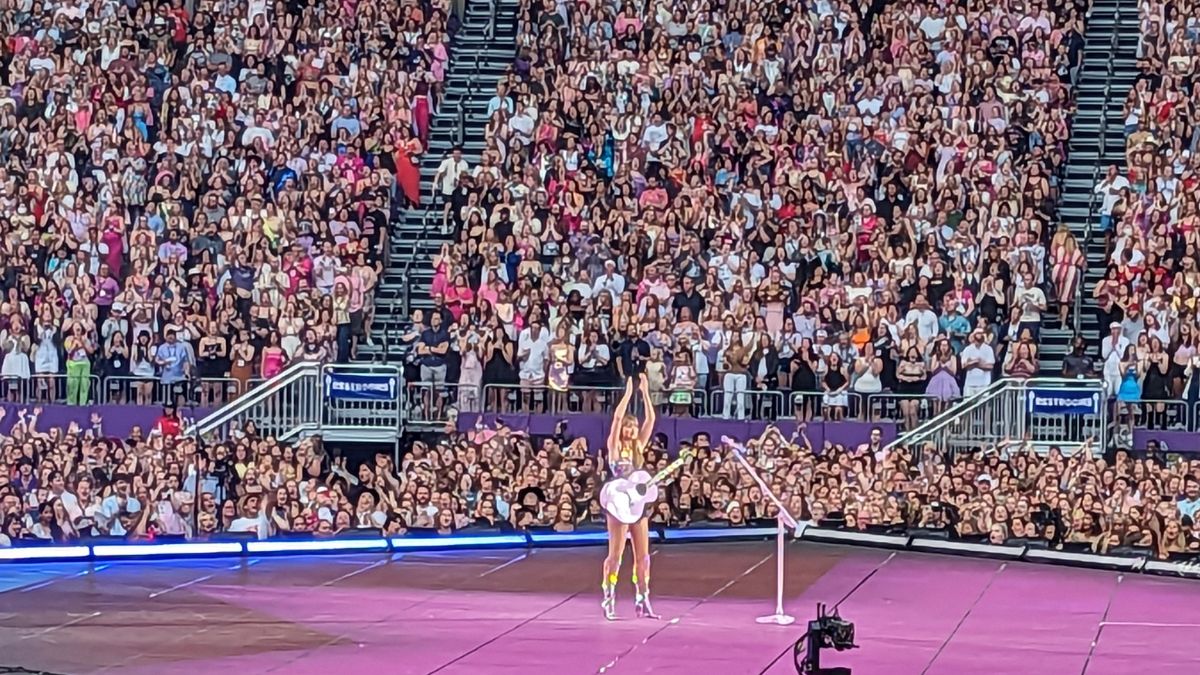

The updated law follows highly sought-after tours this year, including Taylor Swift’s The Eras Tour and Beyonce’s Renaissance Tour. Both tours’ tickets were listed for thousands of dollars on resale sites, alongside tickets to see Lionel Messi after joining Major League Soccer.

However, for the first time, resellers saw a huge increase in fan ticket resellers this year. Rather than resellers mainly consisting of brokers, StubHub found an unusually high number of fans selling tickets — accounting for about 70% of The Eras Tour ticket orders. The company told the WSJ this was double the proportion of what the company normally sees.

Why was there such a sudden jump in fan resellers? Fans are now casually reselling tickets, and amid high ticket prices and a certain demand, they’re cashing in big-time.

This was especially true with Swift’s Ticketmaster fiasco. Simply getting into Swift’s presale was difficult enough with error codes; when fans were finally able to score tickets, many bought more than necessary, knowing they’d never get the chance to get back into the hours-long queue. Whether fans sold tickets for profit — or simply at face value because of changes in plans — this resulted in a massive amount of recirculating tickets at the hands of Swifties.

Messi fans were also able to score big this year; after the soccer star joined Inter Miami FC, tickets rose from $30 to a whopping $255. One season ticket holder told the WSJ that he sold a pair of tickets for $1,100, which helped him already pay-off next year’s season tickets.

While sites like StubHub and TickPick are used to giving out 1099-K forms, this year, that number is off the charts. TickPick told the WSJ they expect to issue at least 10 times as many forms than previous years, and the IRS estimated it will receive 44 million of these forms in 2024 — a huge increase from 11.1 million in 2021.

While the law will certainly be new territory for many new resellers, the change is opposed by some legislators and may be revised. The House Ways and Means Committee approved a bill earlier this year that would see the law restore its original threshold of only reporting if resellers sold more than $20,000. Additionally, a bipartisan bill was introduced in the Senate that falls right in between both options with a threshold at $10,000 and 50 transactions.

For now, resellers can look out for guidance from the IRS ahead of tax-paying season. Forms from resale sites are expected to go out by January 31.