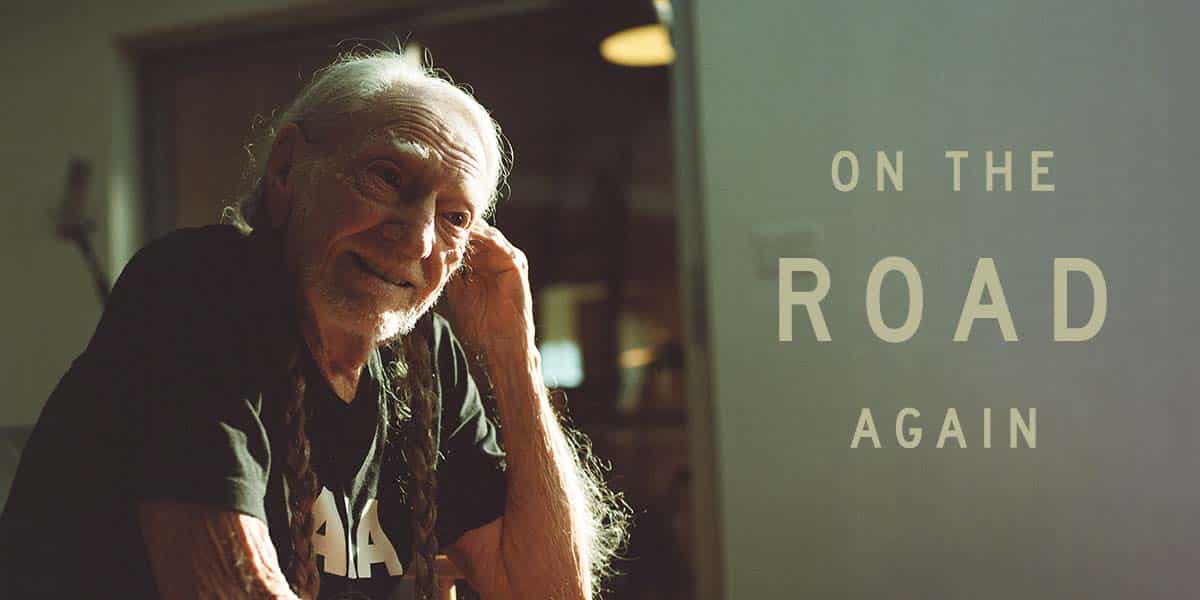

Live Nation is on a public relations mission, hoping to spin the recently announced “On The Road Again” initiative into a public perception that the company isn’t the monopoly that many accuse it of being in live entertainment, but rather a key agent working on behalf of the little guy.

The program, announced in late September, promises significant help to acts playing some of its clubs – an end to the huge cut that the company takes when bands sell their own merchandise at their own shows, plus $1,500 gas/food stipends for the band performing as a headliner or supporter on the bill. On The Road Again is “about making it a little easier for thousands of artists to continue doing what they love: going out and playing for their fans,” stated Michael Rapino, President and CEO of Live Nation Entertainment.

It’s a lovely thing for acts that can take advantage of the offer. However, on closer inspection, it appears to just be a cynical play for sympathetic headlines, with a small impact on limited venues and a potential for further harm to independent venues that can’t possibly hope to match the cash offers as they hope to draw up-and-coming acts to their stages.

Just ask NIVA (National Independent Venue Association), which has already pointed out the program for being a cynical attempt to exert more control over the live entertainment industry. Rather than helping small acts and small venues, it is just another effort to squeeze out competition by the company that already dominates the industry.

Innovative?

Eight months ago, Ineffable Music’s CEO Thomas Cussins announced in January that they would cut merch fees at its 10 venues. He told Billboard that he was influenced by the testimony of Lawrence bandleader Clyde Lawrence during the January hearing the Senate Committee on the Judiciary entitled, “That’s the Ticket: Promoting Competition and Protecting Consumers in Live Entertainment.” Like many of the other witnesses at the hearing, Lawrence lambasted Live Nation’s control of the industry as detrimental to artists, including their requirement to take a cut of merch sales.

Read a portion of Lawrence’s testimony:

“Another pain point for artists is the significant loss of revenues due to promoter merchandise cuts. Typically, the promoter takes a sizable percentage (roughly 20%) of an artist’s merch sales, and once we factor in our costs of creating and transporting the merch, it can be an even larger percentage (40%) of an artist’s bottom line. The argument is that the venue is providing us the retail space for us to sell our merch. Sure. But we’re providing all of the customers, and yet receive no cut from their many ancillary revenue streams. Live Nation getting around 20% of our gross merchandise sales while we get nothing on ticketing fees, bar tabs, coat checks, and parking passes doesn’t make a lot of sense to me.”

The promised benefits are EXTREMELY short-term, and at a limited number of venues.

While some were quick to laud Live Nation’s largesse in not taking a substantial cut of sales of a band’s own merchandise sold during a band’s performance by the band’s merchandise people, the actual benefits are only promised for a short period of time. The length of On The Road Again’s benefits are spoken about in very loose terms. “Over the next few months…” reads one description on the program’s website, but that’s about as much as you get in terms of a promise for the longevity of the benefits.

It is also extremely limited in scope: Just 77 venues are listed as participating in On The Road Again – all of which are directly owned by Live Nation Entertainment. Less than half of the states in the country have even a single venue participating. Canada has a total of seven.

Is the program meant to support artists, or Live Nation’s desire for more control?

NIVA, an advocacy organization for independent venues sees the “On The Road Again” program as another attempt by Live Nation to “squeeze out independent venues.”

“Temporary measures may appear to help artists in the short run but actually can squeeze out independent venues which provide the lifeblood of many artists on thin margins,” NIVA said in a statement. “Instead, it appears to be a calculated attempt to use a publicly-traded conglomerate’s immeasurable resources to divert artists from independent venues and further consolidate control over the live entertainment sector. Such tactics threaten the vitality of small and medium-sized venues under 3000 capacity, many of which still struggle to keep their doors open.”

At the US Senate hearing in January, Live Nation tried to convince the government and its critics that real competition exists in the industry, and that it is losing market value. Live Nation’s leader Joe Berchtold testified that “Ticketmaster has lost, not gained, market share, and every year competitive bidding results in ticketing companies getting less of the economic value in a ticketing contract while venues and teams get more.”

Yet, in July, Music Business Worldwide reported that Live Nation’s Q2 earnings report points towards a company enjoying major commercial prosperity from live music’s growth.

“Revenues from its concerts division came in at $4.63 billion, up 28% YoY on a constant currency basis,” the publication said. “Ticketing (i.e. Ticketmaster) brought in $709.3 million, up 23% YoY, while sponsorships and advertising brought in $302.9 million, up 13% YoY.”

In that same month, Politico reported that sources confirmed that the DOJ could file an antitrust lawsuit against Live Nation/Ticketmaster by the end of the year. A Live Nation representative responded, “We’re in regular contact with the DOJ and they haven’t told us they think we’re doing anything illegal or asked us to address any concerns.”

DOJ investigation or not, their goals to continue to absorb their competition has not slowed. Just in the last several months, it has been reported they have tried to take over several venues and were spurned.

The City of Irvine, California city council “pulled the plug” on a proposed partnership with Live Nation to construct and manage a 10,000-seat amphitheater. Despite overwhelming opposition by residents to the exceedingly lopsided agreement — where the city would pay $130-$140 million in construction costs — Live Nation would have sole control over acts that perform at the amphitheater, would take all revenue from lucrative naming rights, and would be exempt from any future noise ordinances. Even with these obviously unfair terms to the city, Live Nation was one vote away (3-2) from securing approval.

And in San Jose, California, according to the San Jose Spotlight, Live Nation approached Team San Jose to become the sole promoter at the nearly 3,000-seat San Jose Civic in 2021. Although Live Nation’s interest came after woes following the Covid-19 pandemic in the city, where the city had received zero revenue for the year 2020-2021, Team San Jose spokesperson Frances Wong told the publication that the offer did not “align with the city’s vision,” causing Live Nation to pull its interest. In other words, even as broke as San Jose was, they saw how lopsided the deal was against them.

Clearly, one strategy for Live Nation’s growth is to buy as much of the competition as possible. They said so much in the Music Business Worldwide article, where CEO Michael Rapino stated: “…we think we’re headed to a very, very strong 2024, 2025… The consumer demand is growing, and our ongoing bolt-on acquisitions, venues, new market entries, compounded on top of our organic growth, is going to give us this continual one-two punch of growth for the next multiple years.”

Another strategy is to gain greater control of the artists. Providing extra incentives, especially financial, to play their venues will limit the talent available to the smaller venues.

As Lawrence testified to the US Senate, Live Nation’s “horizontal and vertical reach makes it hard to create competition…we truly don’t see Live Nation as the enemy. They are just the largest player in a game that feels stacked against us as artists, and often our fans as well.”

Live Nation’s growth is not good for the consumers as witnessed by their outrageous ticket prices, not good for the smaller independent venues as they have testified to, and certainly not good for the artists.