Concerned over Ticketmaster Entertainment’s “weak” fourth quarter financials, and the company’s possible move to sell TicketsNow and move out of the secondary market, ratings giant Standard & Poor’s (S&P) downgraded Ticketmaster’s rating late Tuesday.

The new “corporate credit and issue-level” rating is “BB,” down from “BB+,” and S&P is keeping the company on CreditWatch with negative implications, it said in a release. Ticketmaster’s stock, which trades under the symbol TKTM, was trading slightly higher today at $4.16 per share, from Tuesday’s close of $4, following the S&P announcement.

“The downgrade reflects Ticketmaster’s weak fourth-quarter operating performance and rising debt leverage,” S&P credit analyst Hal F. Diamond said in a statement. “Furthermore, we believe that Ticketmaster may decide to reduce its presence in the growing secondary ticketing business, which would increase its dependence on the mature and cyclical primary ticket market.”

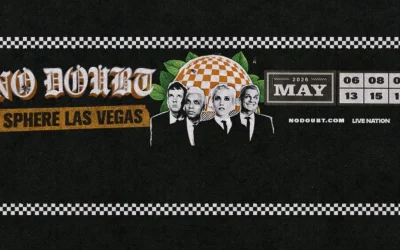

While the company continues with its proposed $2.5 billion merger with Live Nation, the prospect of what Ticketmaster will do about its position in the secondary market remains a bit of a mystery. Both Ticketmaster Entertainment CEO Irving Azoff and Live Nation President and CEO Michael Rapino have spoken negatively about the secondary market, and the National Association of Ticket Brokers has vowed to fight the merger in part because of statements made by the two executives.

But, selling TicketsNow will not be easy in this economy, especially since Ticketmaster paid $265 million for it a year ago. In addition, the company’s TicketExchange has contracts with dozens of sports teams and several artists as a resale hub for their tickets. In addition, if Ticketmaster were to unload TicketsNow and pull out of the secondary market, the company would become more reliant on its primary ticketing business, which S&P believes could suffer this year due to the current recession.

Live Nation’s rating was unchanged at “B,” three notches down from Ticketmaster’s. Live Nation’s stock was also up today to $3.06 from Tuesday’s close at $2.88. The two companies’ debt obligations are both above $800 million each; as of the year end on December 31, Ticketmaster’s debt was $865 million and Live Nation’s was $886 million.