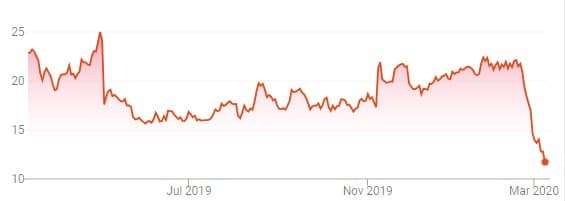

All eyes are on the stock market as a period of uncertainty is dragging down share values. But as the S&P 500 dropped seven percent to begin the week, live event companies are particularly hurting with some stocks reaching 52-week lows.

Live Nation Entertainment (LYV) neared a 52-week high of $76.08 per share less than a month ago but has slipped to a current rate of $48 and change. The company is now flirting with its 52-week low of $46.01. Eventbrite (EB) saw its stocks free-fall to a 52-week low of just under $12 a share.

Additionally, Live Nation also saw its Independent Director Ariel Emanuel sell his 97 percent stake in the company. According to Simply Wall Street, Emanuel recently cashed in a reported $4.2 million by selling his shares for approximately $58.25 each. The publication noted that the entertainment giant saw more insider selling over the past year than insider transactions of more stock.

The market woes circle around the global coronavirus (COVID-19) that has infected over 100,000. As health and government officials warn of the virus’ spread and urge preventative measures, the live event industry has been among the most impacted. The amount of prominent shows and events that have been called off due to coronavirus concerns continues to grow, the most notable thus far being SXSW and Ultra Music Festival and the BNP Paribas Open tennis tournament.

Live Nation CEO Michael Rapino previously downplayed any drastic effect the coronavirus would have on the live event industry noting that the timing of the worldwide outbreak was ahead of the company’s busy season for summer events.

“Most of our business doesn’t start till the middle of June onwards,” Rapino stated. “So the next few months, we’ll have some cancellations, I assume, here and there in some arenas and clubs, but the heart of the business happens this summer.

“When you have a month, two months – anytime you cancel in advance, there’s actually no cost incurred yet, the artist isn’t at the show, the people aren’t in the venue, you haven’t paid the cost,” he continued. “So this is – the easiest economic challenge for us is to reroute and reschedule a show no cost to us.”

However, with dozens of live events in jeopardy and stocks facing equal uncertainty, the industry may be facing a steep decline for the time being.